Medicare Parts A & B have gaps in coverage AND they do not include prescription drug coverage, dental, vision, or hearing.

1 of 2 ways to cover those gaps is through a Medicare Supplement or MediGap plan.

All plans are the EXACT same, company to company, the ONLY thing different is the premium they charge and the rate in which they increase premiums every year.

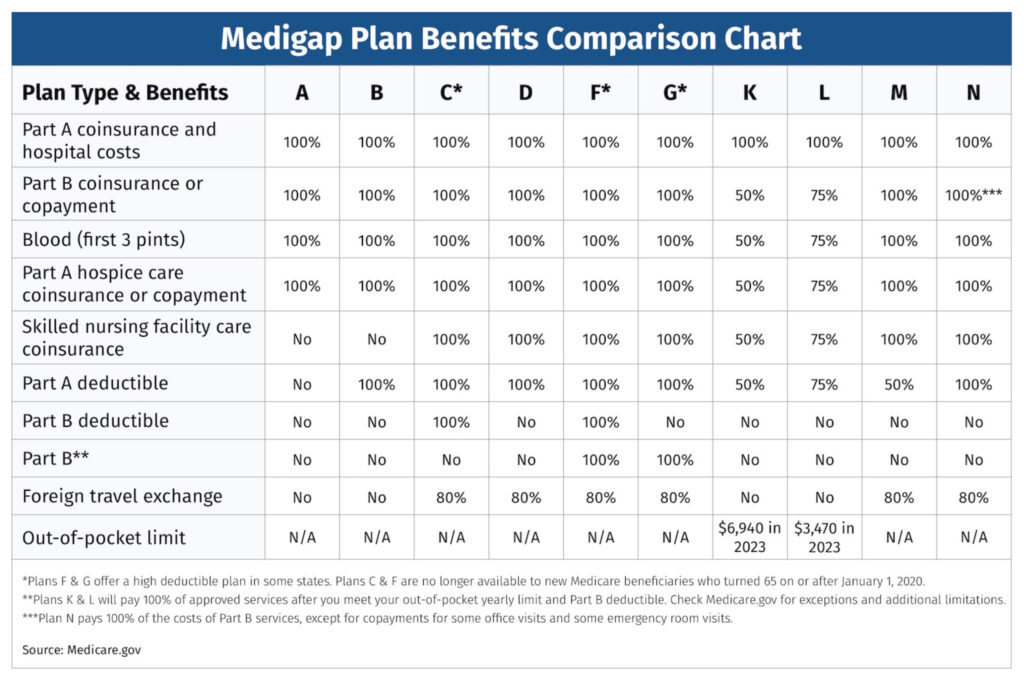

As shown in this chart, Plan G is the most comprehensive; the only thing it does not cover is the Part B deductible for the entire year.

Plan N is the next most comprehensive, it covers everything except the Part B deductible, Part B excess charges, and $20 copays to some doctors and $50 copays to urgent care.

MedSupps do not have enrollment periods, people can change their plan all year round, as long as they are medically eligible.

Underwriting for carriers can be different by state. Below are links to carriers and their underwriting, to give you an idea of what is acceptable or not. Be a full-service agent and talk to people about their Medicare Supplements. The premiums go up every year and that gives you an opportunity to review their plan and help them go through underwriting and make them your client.